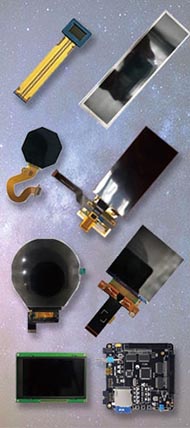

BOE, one of the world’s leading display manufacturers, is reportedly slowing the pace of its investment in flexible OLED production. Industry insiders point to a combination of market saturation, weakened demand, and technical hurdles, especially in yield rates for advanced panel technologies. These challenges are now influencing BOE’s decisions across its display production lines, including flexible lcd screen and flexible display screen technologies.

According to sources, BOE has scaled back its original timeline for its B7 production line in Chengdu, delaying its third-stage investment. This stage would have added a monthly production capacity of 15,000 units of flexible OLED displays. However, the disappointing global demand—especially following weak OLED iPhone sales—has led to downward revisions in production targets. Despite a surge in interest in flexible touch display technologies, BOE is struggling to achieve sufficient yields for its sixth-generation flexible lcd display panels.

Related: OLED Manufacturers In Aisa

According to sources, BOE has scaled back its original timeline for its B7 production line in Chengdu, delaying its third-stage investment. This stage would have added a monthly production capacity of 15,000 units of flexible OLED displays. However, the disappointing global demand—especially following weak OLED iPhone sales—has led to downward revisions in production targets. Despite a surge in interest in flexible touch display technologies, BOE is struggling to achieve sufficient yields for its sixth-generation flexible lcd display panels.

Related: OLED Manufacturers In Aisa

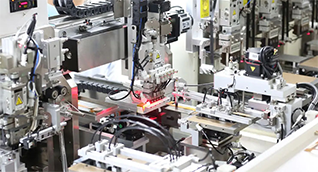

Struggles with FMLOC Technology

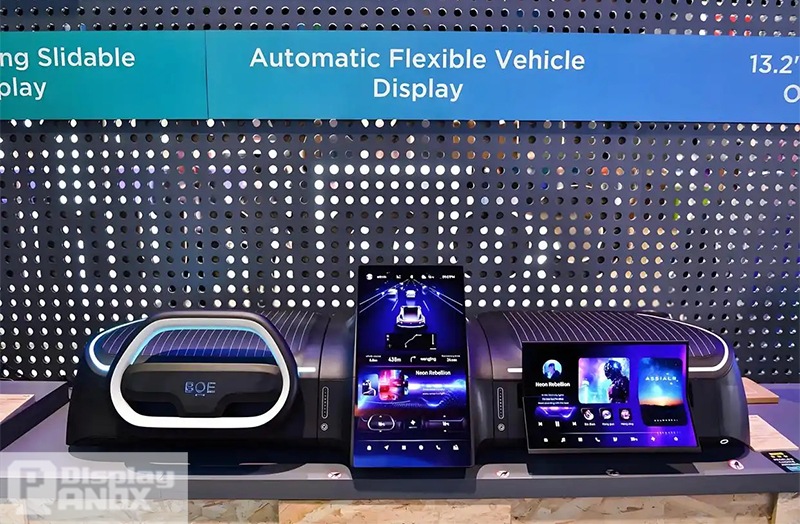

At the heart of BOE’s difficulties is FMLOC (Flexible Multi-Layer On Cell) technology. This touch-integrated solution is a direct rival to Samsung’s Y-Octa technology and is crucial for thinner, high-performance screens like those in premium smartphones. BOE has modified its B11 line to support FMLOC in order to supply panels for Huawei’s flagship P30 Pro. However, the low yield rates for both the front-end and module processes are preventing the company from fulfilling those orders at scale.

With global OLED display price fluctuations and growing pressure from competitors like Samsung Display and LG Display, BOE is in a tight spot. While Samsung’s A3 line and LG’s OLED factory in Guangzhou are expanding rapidly, BOE is seeing a reduced number of shipments and delayed customer schedules. As a result, BOE forecasts a decrease of up to 50 million units in flexible OLED shipments this year compared to last.

Investment Strategy Under Review

Though BOE remains committed to expanding its production capacity, its aggressive strategy is being tempered by market realities. The firm has yet to abandon plans for its B12 and B15 lines but is reviewing investment timelines carefully. Analysts suggest that unless yield rates for flexible screens improve significantly, BOE's transition into premium OLED space may continue to face setbacks.

Meanwhile, for developers and businesses looking for flexible monitors or small batch orders of flexible lcd screens, Panox Display offers tailored services. As BOE prioritizes large-volume contracts, Panox Display ensures access to small and medium-sized display solutions with professional support.

Conclusion

BOE’s recalibration in its OLED strategy reflects broader market trends. The push for thinner, more integrated screens like flexible lcd displays is strong, but technical execution remains a challenge. As demand fluctuates and technologies evolve, the industry will continue watching how BOE balances innovation with performance.

Related: BOE Display Panels OLED/LCD In Stock