Samsung Display Co., LTD (SDC), the renowned display-making subsidiary of Samsung Electronics, has officially scaled back its LCD (liquid crystal display) production as part of a strategic pivot toward more advanced technologies like QD-OLED. According to industry experts, this move reflects Samsung’s response to declining profits, intensified competition from Chinese manufacturers, and falling panel display prices.

This transition is not surprising. SDC.web analysts point out that global LCD panel pricing has been under immense pressure due to oversupply and aggressive expansion by Chinese rivals such as BOE. As a result, Samsung Display has already begun reducing operations at its eighth-generation LCD lines in Asan, South Korea, with some expecting complete suspension of these lines in a phased manner.

LCD Phase-Out: End of an Era?

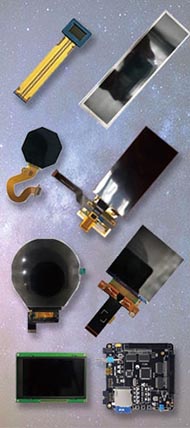

Samsung’s strategy involves significant cutbacks in its pls LCD panel and lcd clear monitor production. This includes trimming output of products like custom LCD displays, color LCD display units, and even clear LCD monitors, which once dominated both the consumer and industrial display markets.

Although the LCD panel era defined a generation of screens—from televisions to parts monitor systems—the tide is shifting. More and more manufacturers are recognizing the limitations of traditional LCD technology when competing against OLED and emerging alternatives.

Shifting to OLED and QD-OLED

SDC is now investing heavily in quantum dot OLED technology. This innovation combines the advantages of OLED’s self-emissive properties with the vibrant color rendering of quantum dots, promising higher efficiency and enhanced display quality for both led display US and international markets.

According to Jeong Won-seok of HI Investment & Securities, “SDC is expected to start investing in new production facilities dedicated to QD-OLED panels in the near future.” This move aligns with Samsung’s broader vision to remain competitive in the premium segment of the display industry.

Global Competition Heats Up

BOE, one of Samsung’s fiercest competitors, has ramped up production with its 10.5-generation LCD panel lines, effectively capturing a large share of the panel display market. LG Display, too, is pivoting away from LCD, investing over $2.5 billion in its next-gen OLED factory in Guangzhou, China.

“Once the Guangzhou factory begins operation, our production capability will double by year-end,” said an LG Display representative. This expansion complements the industry-wide trend where budget-friendly Chinese LCDs are replacing high-cost options like custom LCD panels produced by legacy brands.

What’s Next for Custom Displays?

As the industry transitions, there's increasing focus on custom display solutions. Samsung’s strategic withdrawal from traditional LCD segments may create gaps in miniature, industrial, and custom LCD display markets, possibly opening up opportunities for specialized manufacturers or alternative suppliers in the led display US and global scenes.

Conclusion

Samsung Display’s decision to downsize its LCD operations marks a pivotal moment for the global display industry. With more focus on next-generation technologies, including QD-OLED, color LCD display alternatives, and high-end custom panel displays, Samsung is betting big on the future.

As the shift continues, one thing is clear—lcd clear may soon become OLED sharp, and the race for display supremacy is only just heating up.