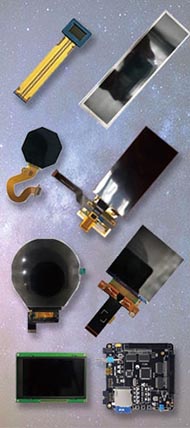

After nearly two decades of development, OLED technology has established itself as a standard in the cell phone market, with a growing presence in tablet PCs, notebooks (NB), and other medium-sized applications. Despite a temporary dip in OLED panel demand due to the receding impact of the terminal epidemic, recent announcements of large-generation OLED IT production lines by companies like BOE signal a promising future. As these large-generation lines become operational, the cost of medium-sized OLED screens is expected to decrease, enhancing OLED technology capabilities and fostering an upgrade in the display industry toward more advanced and higher value-added products. The next 3-5 years are poised to witness a rapid growth period for OLED Notebook.

Supply Situation: Large-Generation OLED IT Production Line Accelerates Supply Growth

OLED Notebook suppliers, previously concentrated in small generation lines like G6, are actively expanding their capacity to capture the growing OLED IT market. Companies such as Hui Optoelectronics, Visuno, and CSOT OLED are strategically laying out low-generation OLED lines, while high-generation OLED lines, specifically G8.7 and G8.6, are becoming a focus for panel factories. Samsung Display and BOE lead in this endeavor, with mass production expected in 2026-2027. LG Display also has plans for high-generation OLED production lines. The landing of multiple G8.x OLED IT lines is anticipated to significantly multiply OLED IT capacity supply, with a projected nearly tenfold growth by 2028.

Related: 15.6 inch 4K OLED