1. Microdisplay Solutions for AI Glasses

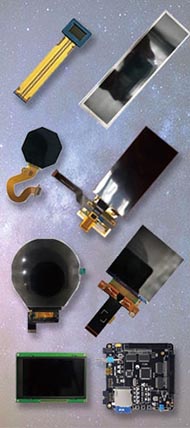

The display technologies used in AI glasses primarily include LCoS, DLP, LBS, Micro OLED, and Micro LED. Each technology has distinct advantages, limitations, and application scenarios.1.1 LCoS

LCoS (Liquid Crystal on Silicon) is a reflective micro-LCD projection technology.It is based on liquid-crystal electro-optical modulation combined with CMOS fabrication. LCoS is known for its mature manufacturing process and low cost. Key characteristics include:

High light-utilization efficiency

Relatively high resolution

Slow response time

Low contrast

Early AR glasses adopting LCoS include Google Glass 1, Magic Leap 1, and Vuzix M300. Today, it is increasingly being replaced by more advanced display options.

1.2 DLP

DLP (Digital Light Processing) is a MEMS-based technology driven by a digital micromirror device (DMD).DLP uses digital light switching by controlling micro-mirrors on the DMD chip to modulate reflected light and display images.

Drawbacks include the well-known rainbow effect in single-chip DLP systems. Although 3-chip DLP eliminates this artifact, its cost is significantly higher, making it difficult to balance image quality and affordability.

Products adopting DLP include AR and MR devices from Vuzix, DigiLens, and the early-generation Microsoft HoloLens.

1.3 LBS

LBS (Laser Beam Scanning) uses laser beams reflected and modulated by scanning mirrors to generate images.Advantages:

High brightness

High contrast

High resolution

Ultra-fast response

Disadvantages:

Larger optical module

Higher cost

Higher power consumption

Examples include North Focals and Microsoft HoloLens 2.

1.4 Micro OLED

Micro OLED (also known as OLED on Silicon) is a self-emissive display technology built on a CMOS backplane using a monocrystalline silicon wafer.Unlike traditional OLED/LCD panels that use glass substrates, Micro OLED leverages silicon wafers, enabling extremely compact, lightweight panels ideal for XR wearables.

Advantages:

Wide color gamut

High contrast

High resolution

Low power consumption

Disadvantages:

Lower peak brightness

Shorter lifespan compared with Micro LED

Micro OLED is currently the dominant solution in the XR market.

(1) MR headsets using Micro OLED:

Apple Vision Pro, Meta Quest Pro, PICO 4 Pro, and others.

(2) AR glasses using Micro OLED:

INMO Air, Rokid Max, XREAL Air, Xrany X1, Thunderbird Air, Lenovo Legion, Honor Vision Glass, etc.

1.5 Micro LED

Micro LED refers to miniaturized LED arrays transferred onto a circuit substrate using advanced mass-transfer technology. Each pixel is a self-emitting, micron-scale LED.Micro LED offers outstanding performance characteristics:

High resolution

Extremely high brightness

Very compact size

Long lifespan

However, the technology is still maturing. Challenges include low yield in mass-transfer processes and high manufacturing difficulty.

Products using Micro LED include: Thunderbird X2, Meizu MYVU Discovery, Liweike Meta Lens, INMO Go, Ultralite, and others.

2. Optical + Display System Architecture

Optics play a critical role in AI glasses—focusing light into the eye while preserving visibility of the real world.Current mainstream optical systems include free-form prisms and BirdBath optics, while future development is trending toward optical waveguides.

When optical and display systems are properly matched, overall performance can exceed the sum of their parts. The two major long-term mainstream combinations are:

Micro OLED + BirdBath optics

Micro LED + Waveguide optics

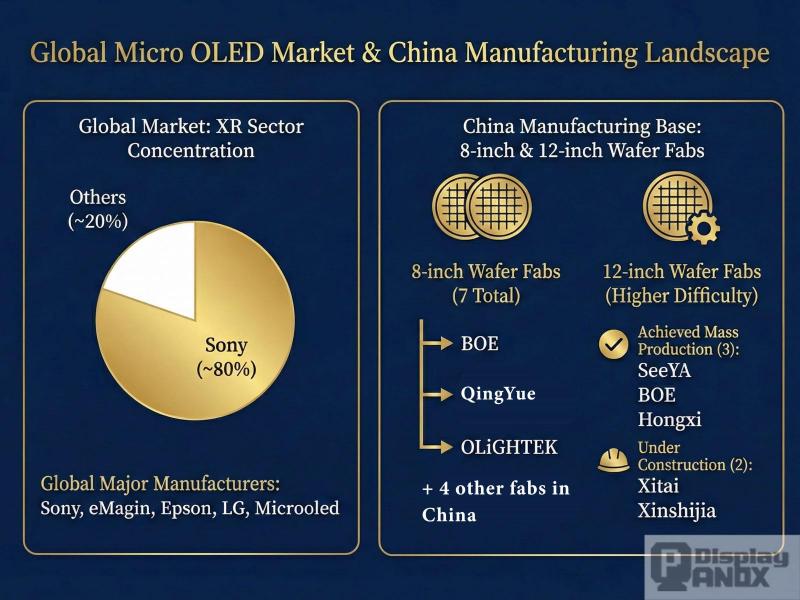

3. Market Landscape of Micro OLED

Only a limited number of companies worldwide can mass-produce Micro OLED. Major global manufacturers include:Sony, eMagin, Epson, LG, Microoled.

Within the XR sector, the market is highly concentrated, with Sony controlling nearly 80% of global supply.

China’s Micro OLED manufacturing base

8-inch wafer fabs:

BOE, SeeYA Technology, OLiGHTEK, Ray Display, GuoZhao Optoelectronics, CuiSong Optoelectronics, QingYue Technology — 7 fabs total.

12-inch wafer fabs:

Higher difficulty in wafer processing; only three companies have achieved mass production:

SeeYA Technology

BOE

Hongxi Technology

Two additional fabs (Xitai Technology, Xinshijia) are under construction.

4. Market Landscape of Micro LED

Leading global Micro LED companies include:

Samsung, Sony, LG, AUO, AIXTRON.

China’s Micro LED ecosystem

Module manufacturers:

JBD (Jingneng Display), Sintaint, BOE, TCL CSOT, Goertek, NationStar Optoelectronics, HC SemiTek, Leyard, Konka.

Chip manufacturers:

San’an Optoelectronics, HC SemiTek.