Hefei BOE EV Intelligent Equipment — OLED Evaporation System

Chinese companies are carving out a critical position in the global OLED equipment market, signaling a transformative shift in the industry.

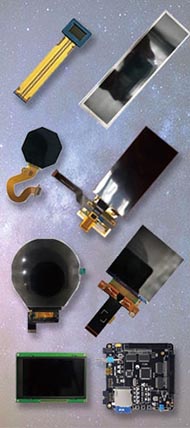

As the global OLED industry rapidly pivots toward medium and large-sized displays, China’s OLED supply chain is undergoing a profound transformation. At the heart of this shift is the localization of OLED manufacturing equipment — a journey from technological dependence to independent innovation. From front-end photolithography to mid-stage evaporation and back-end module assembly, Chinese companies are steadily breaking through technical bottlenecks and dismantling the long-standing dominance of foreign suppliers.

The Time is Now for OLED Equipment Localization

The center of gravity in the global OLED industry is shifting decisively toward China. According to Omdia, as of January 2025, China’s market share in small-to-medium OLED displays has reached nearly 50%, overtaking South Korea to become the global leader for the first time.

However, while China is now leading in panel production, localized equipment adoption still lags behind. Data from CINNO Research shows that Chinese suppliers account for just 39% of the OLED process equipment market overall, with less than 20% penetration in critical front-end steps like evaporation and photolithography.

Wang Jiantai, Director of Technical Planning at Leadtech Equipment, explained in an interview with China Electronics News that China has made significant strides in downstream module equipment — such as cutting, lamination, and bonding — with localization rates exceeding 85%. But upstream, high-barrier segments like photolithography, etching, and evaporation are still largely dependent on global giants like Canon Tokki, Nikon, and Tokyo Electron.

This imbalance has real consequences. A technical executive at a domestic panel maker recalled that their Gen-6 OLED production line faced a six-month delay due solely to the wait for a Canon Tokki evaporation machine. The phrase “hard to get one machine” captures the challenge facing China’s OLED industry.

Signs of Progress: Key Equipment Localization Gains Momentum

Industry experts agree: the key to high-end OLED development lies in mastering core equipment. Today, a wave of Chinese tech firms is rising to the challenge, bringing tangible progress to OLED equipment localization.

Etching, often referred to as the “scalpel” for precision circuit patterning, was once monopolized by overseas players. Now, leading Chinese semiconductor equipment maker AMEC has developed advanced etching tools with enhanced precision and lower process complexity, making them viable for OLED production. Their equipment is reportedly being used by international panel makers.

In inspection equipment — the “gatekeeper” of yield and quality — ScopeChip Electronics has emerged as a domestic leader. Its self-developed Optical Critical Dimension (OCD) metrology system achieves nanometer-level thickness measurement with an error margin below 0.5%. At its June 2025 earnings call, the company confirmed major orders from tier-one display makers.

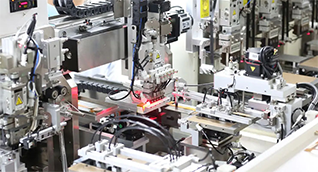

Huaxing Yuanchuang is also innovating in automation. Their patented systems integrate machine learning and multimodal AI to deliver full-process automation from sorting to packaging. These capabilities not only boost production efficiency but also reduce maintenance costs — a true “Chinese solution” for intelligent OLED manufacturing.

Evaporation: The Strategic Breakthrough

Evaporation is the most technically demanding step in OLED panel production, directly impacting yield and display quality. Localizing this process would mark a decisive breakthrough.

According to Cao Jingbo, General Manager of Hefei BOE EV Intelligent Equipment, the company has developed a complete G1–G6 evaporation platform and is now focusing on G8.6 systems. Key technological hurdles — such as high-precision mask alignment (≤2μm) and uniform film thickness (±1.5%) on large substrates — have been successfully overcome.

“While our evaporation tools may not yet match Canon Tokki in long-term stability, they meet production requirements and offer a 20–30% cost advantage, along with stronger local service support,” said Cao.

G8.6: A Crucible for Chinese Equipment

According to DSCC, the global OLED panel market surpassed $42 billion in 2023, with small displays (mainly smartphones) making up 67% and mid-size segments like tablets and laptops growing 45% year-on-year.

Demand from foldable phones OLED, smart vehicles, and high-end IT devices is driving OLED into larger formats. Global panel leaders — including Samsung Display, LG Display, BOE, and Visionox — are ramping up investment in high-generation (G8.6 and above) OLED fabs targeting medium-to-large displays.

With equipment accounting for 70–80% of OLED line CAPEX, the rise of G8.6 lines brings an unprecedented opportunity for domestic suppliers to validate their technology and scale up rapidly.

Recently, multiple breakthroughs in G8.6 OLED equipment have been announced. Suzhou Jiazhi Color, a subsidiary of Karen Tech, delivered China’s first G8.6 OLED De-Mura system, solving speed and precision issues for large, high-resolution panels. Meanwhile, Huaxing Yuanchuang’s Chengdu branch shipped the country’s first G8.6 AMOLED TSP OS inspection system, offering micron-level accuracy for automotive, notebook, and tablet applications.

On the evaporation side, Hefei BOE EV’s independently developed G8.6 point-source evaporation system passed validation by a major panel customer — filling a critical gap in the supply chain. Its full G8.6 evaporation system is also progressing steadily.

In module bonding, Leadtech Equipment successfully localized large-area lamination tools for BOE’s G8.6 AMOLED line. Their EHD dispensing and high-gen lamination systems have passed customer evaluations and are expected to move into mass production.

Looking Ahead: From Equipment Importer to Tech Exporter

Industry insiders view the next three years as a critical window. As G8.6 OLED lines ramp up and more high-gen projects launch, demand for high-end equipment will skyrocket — accelerating localization and potentially transforming China from a technology importer into a global equipment exporter.

High-generation OLED lines are not only capacity drivers but also litmus tests for equipment quality. If China can overcome its “strong backend, weak frontend” imbalance, and become a trusted supplier of advanced equipment, its influence in the global display industry will reach new heights.

As Hefei BOE EV’s Cao Jingbo puts it:

“The true turning point will come when global panel giants start lining up to buy Chinese evaporation tools. That’s when the industry will have truly turned the page.”