In the spring of 2025, Shenzhen’s skies turned grey, mirroring the uncertain future of one of China’s most prominent tech unicorns — Royole, once hailed as a global innovator in flexible OLED technology. Once valued at over RMB 50 billion (approximately USD 7 billion), Royole Corporation is now under bankruptcy review, its ambitious vision for next-generation displays clouded by financial woes and operational setbacks.

A Flexible OLED Unicorn on the Edge

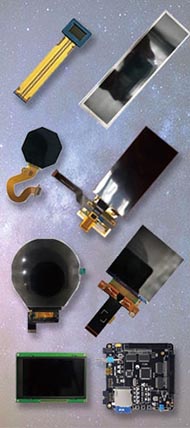

Founded in 2012, Royole quickly rose to fame as a pioneer in flexible OLED displays. With bold claims of redefining how people interact with electronic devices, the company developed its own proprietary technology — the ULT-NSSP (Ultra-Low Temperature Non-Silicon Process Platform), which it positioned as a superior alternative to traditional LTPS (Low-Temperature Polycrystalline Silicon) used by established display makers like Samsung, BOE, and TCL.

In 2018, Royole launched the FlexPai, the world’s first commercial foldable smartphone powered by a Royole flexible OLED display. This milestone gave Royole first-mover advantage in a market that was just beginning to explore foldable and bendable screens. That same year, the company’s massive RMB 11 billion flexible display production base in Shenzhen went online, with an annual production capacity of over 50 million units.

From Global Recognition to Market Challenges

Royole’s founder, Dr. Bill Liu (Liu Zihong), a Stanford PhD and former Tsinghua graduate, was celebrated as a tech prodigy. He envisioned a world where flexible OLED screens would revolutionize industries — from mobile devices and smart wearables to automotive, education, retail, and beyond. Royole’s vision was to create the next-generation human-machine interface using ultra-thin, bendable, and rollable displays.

For a while, the dream seemed real. Royole was listed among China’s top unicorns and completed 13 rounds of financing. Dr. Liu was named a World Economic Forum Young Global Leader and included in Fortune’s “40 Under 40” list. The Royole flexible OLED brand was widely discussed at global tech expos, and its demos captured attention worldwide.

Yet despite its technology, Royole struggled with one critical issue: commercialization. Major smartphone brands like Huawei, Xiaomi, and Samsung opted for other suppliers. Royole’s foldable screens, though innovative, failed to break into large-scale partnerships. Outside of mobile phones, its flexible displays — showcased in applications like smart speakers, signage, and conference panels — didn’t see significant adoption. Market readiness lagged behind Royole’s R&D.

Financial Stress and IPO Withdrawal

The company’s financial strain became public in late 2020, when Royole filed to go public on China’s STAR Market with a proposed fundraising goal of RMB 14.4 billion. But just two months later, the IPO was withdrawn. Royole cited shareholder structure issues, but its prospectus revealed deeper concerns: from 2017 to mid-2020, the company had revenue of only RMB 517 million — while losses exceeded RMB 3.1 billion.

More alarmingly, Royole’s flexible OLED panel production volume remained low despite the scale of its investment. In 2019, for example, only 52,700 units were sold. Observers began to question not only the scalability of the Royole flexible OLED production line, but also the market fit for its technology.

Since then, things have worsened. The company has faced wage delays, mass employee departures, and increasing creditor lawsuits. As of mid-2025, Royole faces over RMB 3 billion in enforcement claims, and the founder himself is under consumption restriction orders.

Industry Value and National Strategy

Despite its difficulties, industry experts continue to stress the strategic value of Royole’s flexible OLED technology. According to Professor Liu Shuwei, an independent board member and senior researcher, Royole’s ULT-NSSP route offers China a rare opportunity to develop domestic, proprietary display technology, potentially freeing the industry from dependence on foreign technical standards.

The Royole flexible OLED platform, she argues, represents more than a business — it’s part of China’s strategic path toward display self-reliance and global competitiveness in advanced electronics manufacturing.

Can Royole Still Be Part of the Future?

On Royole’s official website, one still finds optimistic forecasts: global flexible and printed electronics are projected to reach $330 billion USD by 2027, with flexible OLED displays taking the lead. But the question remains — can Royole survive long enough to participate in that future?

Today, its Shenzhen factory is largely inactive. Reports from the field describe locked gates, silent production floors, and a headcount that has fallen from 1,800 to just a few hundred. Vendors and workers speak of unpaid salaries and halted projects.

The Royole flexible OLED story is both inspiring and sobering. It highlights the potential of Chinese innovation and the challenges of turning deep tech into sustainable business. While Royole’s technical achievements remain impressive, the road to commercial success — in the highly competitive and capital-intensive world of flexible OLED — is fraught with risk.

As the industry accelerates, new players are entering the market, and global giants are doubling down on foldables. Whether Royole can reinvent itself — or fade into history as a brilliant but unfinished chapter — is a question still waiting to be answered.