Semi Display, June 19.As major display manufacturers ramp up large-scale investments in small-to-medium-sized OLED technology, the global market is heating up fast. Industry analysts expect demand for OLED panels in this segment to continue rising steadily.

According to a June 19 report by UBI Research, OLED panel shipments for laptops and tablets reached 8.46 million and 7.5 million units respectively in 2023, representing year-on-year growth of 57% and an impressive 400%. Interestingly, while the number of OLED laptop models dropped from 52 in 2022 to 44 in 2023, that figure is expected to nearly double to 80 models by 2024.

The future outlook remains strong. OLED, which has firmly established itself in the high-end smartphone segment, is now quickly gaining traction in IT devices—especially premium models. In addition to Apple, Chinese tech giants such as Xiaomi, Huawei, and OPPO are accelerating the shift from LCD to OLED in their tablet offerings, with new OLED tablet models expected in the second half of 2024.

UBI Research forecasts that OLED shipments for laptops and tablets will reach 10.8 million and 16 million units respectively by 2025. By 2028, shipments of OLED panels for IT applications are expected to exceed 50 million units.

Data from market research firm Omdia shows that Samsung Display captured a 40.9% share of the global small-to-medium OLED market in Q1 2024. Samsung is investing KRW 4.1 trillion (approx. USD 3 billion) between 2023 and 2025 to establish a Gen 8.6 OLED production line for IT applications. Once operational, this new line is expected to boost annual output from the current 4.5 million units (based on Gen 6 equipment) to over 10 million units of 14.3-inch tablet panels—significantly enhancing production efficiency and market competitiveness.

Meanwhile, China’s top display maker BOE has fast-tracked its adoption of Gen 8.6 OLED production equipment—four months ahead of schedule. With mass production targeted for late 2026, BOE aims to achieve a monthly capacity of 32,000 panels.

Korean media note that BOE secured an 18.5% share of the small-to-medium OLED market in Q1 2024—nearly matching LG Display’s 19.0%. With several other Chinese display companies also building new OLED lines, concerns are growing in South Korea about its diminishing dominance not only in the LCD space but now increasingly in OLED as well.

BOE 5.99 flexible OLED

In response, LG Display is investing KRW 1.26 trillion (approx. USD 910 million) to expand its presence in the small-to-medium OLED sector. Roughly KRW 700 billion will go toward new equipment at its Goyang plant in Gyeonggi Province, while the remaining KRW 560 billion will be used for a simplified assembly line in Haiphong, Vietnam. The investment will run through June 30, 2027.

With this initiative, LG Display aims to significantly strengthen its OLED capabilities for smartphones and tablets. While the company maintains a dominant share of over 90% in the large-size OLED market (such as TVs and gaming monitors), it still lags behind in the small-to-medium segment.

An LG Display representative stated: “We are focusing investment in next-generation OLED technologies at our Goyang plant to proactively respond to the rapidly growing global demand for OLED panels.”

Verification Code*

Panox Display

Browse Articles by Category

OEM SERVICE

Customized Touch Panel

HDMI/Type-C Controller/Driver Board

Custmized LCD/OLED

Free Connectors

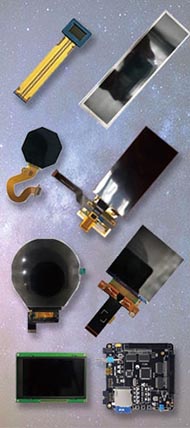

Find a Display to Fit Your Application

For More OLED/LCD Panels

Get the Latest Displays

If our display fit your application, subscrlbe for monthly Insights

We got your inquiry and will contact you within one work day.

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798