If you’re building AR/VR/MR products, you already know the truth: image quality isn’t just about “the OLED.” In Micro OLED (also called OLED-on-Silicon / OLEDoS), the CMOS backplane and its driver architecture are the real control center—deciding pixel accuracy, response speed, uniformity, power, and ultimately whether your headset feels premium or fatiguing.

This post explains what Micro OLED backplanes/drivers actually do, which downstream markets are driving demand, how the ecosystem is scaling, and what technical trends you should track if you’re sourcing Micro OLED microdisplays for real products (not lab demos).

What “Micro OLED backplane/driver” really means (and why it matters)

A Micro OLED microdisplay is built on a silicon CMOS backplane, where each pixel is controlled by tiny transistors and drive circuits, then paired with an OLED emissive stack on top. That silicon foundation enables extremely high pixel density, fast switching, and tight integration—exactly what near-eye optics require.

In practice, the backplane/driver design affects things buyers actually feel:

· Uniformity & mura control: At microdisplay pixel sizes, tiny electrical variations become visible. Backplane compensation and stable driving matter as much as the OLED stack.

· Latency & motion clarity: Driver timing and scan strategy influence perceived lag and comfort in XR.

· Power & thermal behavior: XR devices are power-sensitive and heat-limited. Efficient drive schemes and integration reduce system overhead.

· Scalability: Great demos are easy; consistent mass production is not. Backplane/driver maturity is a major differentiator for supply reliability.

Downstream demand: where Micro OLED backplanes/drivers are growing fastest.

1) XR devices (AR/VR/MR headsets)

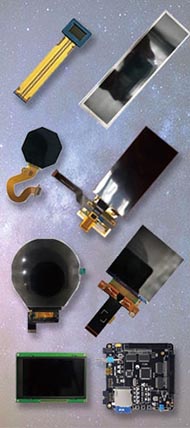

Micro OLED is increasingly preferred for premium XR because it can deliver ultra-high PPI, high contrast, fast response, and thin optical engines. Compared with fast LCD paths, Micro OLED can push sharper text/UI and reduce visible pixel structure (depending on optical design), while keeping form factor compact. That’s why many teams treat Micro OLED as the “high-end route” when visual comfort and clarity are top priorities.

2) Electronic Viewfinders (EVF) for cameras

EVFs demand crisp detail, deep blacks, and accurate tonal transitions—Micro OLED’s strengths. The small size also helps reduce camera bulk and supports modern compact body design. EVF heritage is also a major reason Micro OLED manufacturing and miniaturization matured so early.

3) Thermal imaging & night vision

For harsh environments, Micro OLED can be engineered to operate across wide temperature ranges, while its high contrast supports readability in low-light conditions. For night vision and observation tools, “stable contrast + clean grayscale” is often more valuable than raw brightness alone.

4) Other high-end optical systems

Automotive HUD modules, digital observation instruments, and aviation helmet displays are also relevant. These applications tend to value reliability, integration, and supply stability—again putting the spotlight on backplane/driver design maturity rather than only panel headline specs.

Related: AR display panel

Micro OLED Applications

Market momentum: how big is the opportunity?

Because “Micro OLED backplane/driver” isn’t always separated as its own standalone public market category, the most commonly cited industry numbers use OLEDoS (Micro OLED) market sizing. Those figures still reflect the same demand wave that drives backplane/driver innovation and shipments.

-

One widely cited forecast projects the OLED-on-Silicon (OLEDoS) market growing from USD 534M (2024) to USD 2.352B (2029), implying strong multi-year expansion driven largely by near-eye displays.

-

On the ecosystem side, Samsung Display’s acquisition of eMagin (an OLED microdisplay company) was completed and publicly announced—another signal that major display players see Micro OLED as strategic.

Bottom line: whether you measure by units or revenue, the direction is clear—near-eye demand is pulling Micro OLED forward, and the backplane/driver stack is where a lot of the differentiation (and cost structure) lives.

What’s driving the backplane/driver evolution?

XR growth + higher spec requirements

XR adoption expands into gaming, training, education, medical visualization, and industrial workflows, which increases demand for high resolution + high refresh + low latency displays. That naturally pushes the backplane/driver layer to evolve, because it’s the part responsible for timing, control, and efficient pixel operation.

Semiconductor manufacturing progress

CMOS scaling and integration improvements allow more functions to move onto the same silicon—raising performance while shrinking size and improving energy efficiency. This is exactly why “Micro OLED” is fundamentally tied to semiconductor capability, not only OLED materials.

More integration: touch, power management, and image processing hooks

The trend is toward “smarter” microdisplay platforms: not just pixels, but a tighter system that supports compact modules and easier product integration. Your original draft’s direction here is right; the blog version is simply to frame it as integration pressure from XR form factors.

Key technology trends to watch (2026+)

1) 4K+ resolution and higher pixel density (PPI)

Backplanes/drivers will keep pushing toward 4K-class microdisplays and beyond, because near-eye optics expose pixel structure brutally. Sony’s 1.3-type 4K OLED microdisplay announcement is a concrete example of this direction and the emphasis on high-definition VR/AR experiences.

2) Higher usable brightness through stack and optical efficiency

Brighter is not just “more current.” As the industry explores stacked approaches and optical efficiency improvements, the driver side must also handle stable operation, heat, and uniformity at higher luminance targets.

3) More integrated driver functions on silicon

Expect stronger integration of timing control, power functions, compensation/calibration support, and system interfaces—all designed to simplify headset design and reduce overall system complexity.

4) Better motion performance with high refresh + stable grayscale

High refresh alone isn’t enough; you want predictable grayscale behavior, low persistence strategies, and stable image quality under real thermal conditions. That’s where backplane/driver architecture becomes a spec worth asking about—not just “Hz.”

5) “Will Micro OLED replace fast LCD in XR?”

For mass-market price tiers, fast LCD will remain relevant. But for premium XR where clarity, contrast, and comfort are prioritized, Micro OLED adoption is likely to keep expanding—especially as supply chain competition improves cost and availability over time.

Sourcing checklist: what to ask before you buy Micro OLED

If your goal is to ship, not just prototype, here are the practical questions:

1.Uniformity strategy: What compensation or calibration support exists for mura and brightness variation?

2.Interface & timing: What input interface, bandwidth, and timing constraints do you need to design around?

3.Brightness vs lifetime: What’s the sustained brightness behavior under thermal limits (not just peak)?

4.Power & thermal envelope: What power profile should the system budget for typical XR content?

5.Engineering support: Is there a proven bring-up path (docs, eval kit, reference design), and stable lead time?

Micro OLED for real products: where Panox Display fits

If you’re developing AR/VR/MR headsets, EVFs, thermal imaging, or night-vision/observation systems, Micro OLED (OLEDoS) is one of the most direct ways to deliver sharpness, contrast, fast response, and compact integration. The key is choosing microdisplays backed by a driver/backplane stack that behaves predictably in your optical and thermal conditions.

Panox Display offers Micro OLED products and integration support to help teams move faster from evaluation to production—without painful surprises in optics, timing, or stability.

Learn more: MicroLED “Back From the Ashes” — and What It Means for Micro OLED Buyers in 2026