According to Taiwan media reports, South Korea’s Samsung Group has committed to purchasing 56 million LCD panels and shipping 48 million TV units this year. These figures would constitute a sharp increase – of 16.7% and 14.3%, respectively – compared to last year. These increases will be driven by Samsung purchasing more than 10 million LCD displays from Innolux and AUO, with the total LCD panel supply from both companies increasing 14% on last year’s total.

An important backdrop to this story is that Samsung Group will, in June this year, shut down its only LCD panel factory in South Korea and officially cease producing its own LCD panels. That move comes half a year earlier than expected, but the Group’s Image Display Division (VD) still requires panels and is therefore continuing to book shipments with foreign suppliers. This development is driving strong demand for LCD panels and provides an opportunity for the likes of Innolux and AUO to grow and become even bigger players in the industry.

AUO TV panel sales in the third quarter of last year dropped to 21%. The company’s chairman, Peng Shuanglang, has said that the proportion of TV panel shipments will remain at around 20% this year, with the main consideration being to continue serving TV brand customers. He stressed that AUO remains committed to its existing product portfolio, which is focused in large part on meeting long-term demand in the high-end TV market, but that the company’s business strategy is also placing increasing importance on the automotive market, where, by working directly with automakers, AUO is seen to have opportunities to expands its business opportunities and markets.

In a similar vein, the chairman of Innolux, Hong Jinyang, has said that, while there may not be the sudden demand witnessed last year, he is nonetheless cautiously optimistic about this year’s operation. Innolux has retained its high order, high value-added product layout. This strategy is one based on the production of high value-added products over the production of large quantities of standard products. Adherence to this strategy is likely to slow down the impact of panel prices.

Innolux’s General Manager, Yang Zhuxiang, has pointed out that the company will continue to pay close attention to international developments and has the ability to dynamically adjust its operations accordingly. At present, however, there remains high demand in the panel market. With the early withdrawal of Samsung from the LCD business, the market is under-occupied, with sustained demand but fewer suppliers, and the market price is expected to stabilize.

According to India's latest report, Samsung's Image Display Division purchased about 48 million panels in 2021 and shipped 42 million units. In 2022, meanwhile, it plans to purchase 56 million panels and ship 48 million units in 2022. The panels it purchases will be made up of 53 million OPEN Cell LCD TVs, 1 million QD OLED panels, and 2 million WOLED TV panels.

Verification Code*

Panox Display

Browse Articles by Category

OEM SERVICE

Customized Touch Panel

HDMI/Type-C Controller/Driver Board

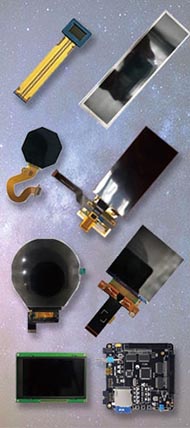

Custmized LCD/OLED

Free Connectors

Find a Display to Fit Your Application

For More OLED/LCD Panels

Get the Latest Displays

If our display fit your application, subscrlbe for monthly Insights

We got your inquiry and will contact you within one work day.

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798