In a recent interview at the company's research center in Seongnam, Gyeonggi Province, Park Young-geun, CEO of Toprun Total Solution, expressed strong confidence in the growth of OLED in the automotive sector. “LCDs are still dominant in automotive displays, but OLED will rise rapidly,” Park stated. “In line with this trend, we are initiating vertical integration of our OLED small business operations starting this year.”

Founded in 2004, Toprun Total Solution has supplied vehicle electronic components such as headlamps to major manufacturers including LG Electronics and LG Display for over two decades. The company also produces structural reinforcements for smartphone camera modules and large-format TV signage panels. Despite a diversified portfolio, Toprun’s overall sales have remained relatively flat due to stagnation in the smartphone and large display markets. However, the automotive electronics segment has stood out, achieving double-digit growth annually.

One of Toprun's fastest-growing product lines is LCD backlight units (BLUs) used in vehicle instrument clusters. In fact, this segment alone accounts for 37% of the company's total revenue (195.4 billion KRW). These BLUs, combined with LG Display’s LCD panels, are supplied to premium automakers such as Mercedes-Benz, BMW, and Hyundai.

Park highlighted the expanding demand for in-vehicle displays, saying, “A luxury vehicle can incorporate up to seven screens—from rearview mirrors and dashboards to co-pilot and rear-seat entertainment displays. We anticipate sustained market leadership through 2029.”

In response to rising global demand, LG Display is now developing modules tailored for mid- to entry-level vehicles and expanding into emerging markets like India, where adoption of in-car displays is still at an early stage—offering significant growth potential.

Toprun’s next major initiative is vehicle OLED components. Since its public listing in November last year, the company has strategically acquired OLED-related businesses. Earlier this year, it acquired TopRun AP Solution (formerly AP Solution) for 18 billion KRW. This subsidiary manufactures optical compensation equipment used to calibrate OLED screen colors. Toprun aims to secure core OLED technologies by next year—enabling in-house design and production of OLED components for both mobile and automotive applications, as well as the supply of related optical calibration equipment.

Although OLED revenues were just 21.1 billion KRW last year—one-ninth of BLU sales—the long-term potential is considerable. OLED currently represents 15% of the automotive display market, but industry analysts forecast this figure will climb to 30% by 2031.

Park emphasized the strength of Korean OLED technology, noting that Korean companies continue to lead the global automotive OLED sector. According to research firm Omdia, Samsung Display and LG Display command 55.2% and 21% of the market, respectively—far surpassing their Chinese competitors. “Korean firms still hold a competitive edge in both high-end LCD and flexible plastic OLED technologies,” Park said. “We are committed to reinforcing this lead and staying ahead in the automotive OLED race.”

Verification Code*

Panox Display

Browse Articles by Category

OEM SERVICE

Customized Touch Panel

HDMI/Type-C Controller/Driver Board

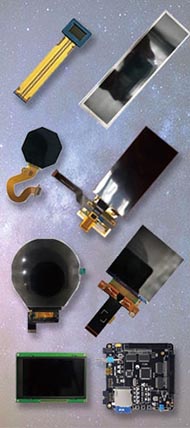

Custmized LCD/OLED

Free Connectors

Find a Display to Fit Your Application

For More OLED/LCD Panels

Get the Latest Displays

If our display fit your application, subscrlbe for monthly Insights

We got your inquiry and will contact you within one work day.

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798