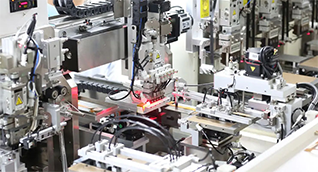

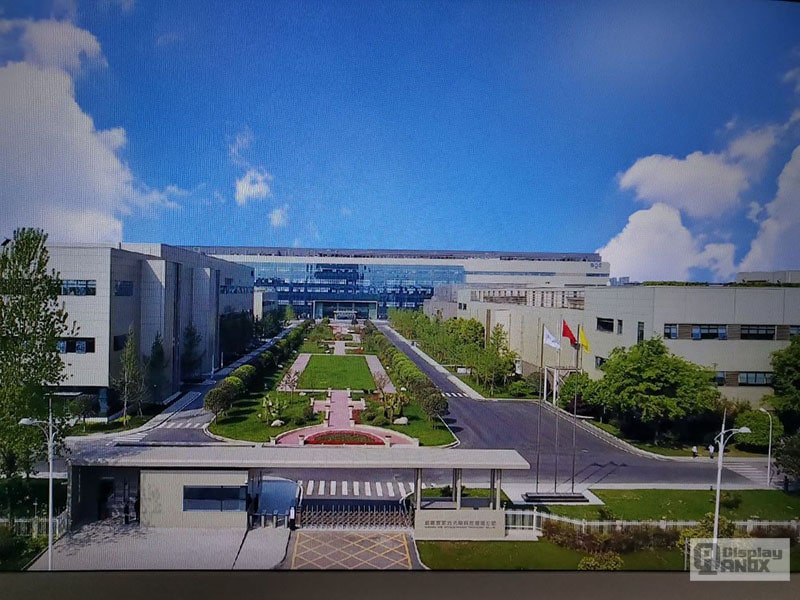

BOE Chengdu Factory

BOE has announced a substantial investment of 63 billion yuan in the construction of an 8.6 generation AMOLED production line, signaling intensified competition with Samsung in the large-size OLED panel sector. The project, located in Chengdu, Sichuan, represents the latest high-generation OLED panel production line. In collaboration with Chengdu Hi-Tech Zone's designated investment platform and Electronics Company, the project is named Chengdu BOE Display Technology Co.

The competition extends globally, with Samsung Display planning an 8.6 generation AMOLED production line dedicated to tablet PCs, laptops, and IT panel applications. Samsung's ambitious investment of 21.5 billion yuan aims for mass production by 2026. Notably, Apple is also anticipated to adopt OLED screens in its iPad Pro model by 2024, with plans for OLED-equipped MacBooks in 2026-2027, utilizing Hybrid OLED technology.

BOE's strategy involves upgrading display technology in its 8.6th generation AMOLED production line, focusing on Hybrid OLED technology. This approach combines glass as a base with TFE flexible encapsulation technology, enhancing power efficiency, lifespan, and picture quality. The competition among industry leaders intensifies not only in technology but also in production capacity.

Gate of BOE Chengdu factory

The announcement emphasizes BOE's goal to establish the world's first 8.6 Gen high-generation AMOLED semiconductor display production line, aiming to synchronize with international industry launches and seize strategic opportunities. Collaborating with renowned brands, BOE aims to drive the adoption of OLED screens in medium-sized IT products, opening up a broader market for such displays.

Analysts foresee significant growth in OLED IT supply capacity with Samsung, BOE, and LG Display investing in high-generation OLED production lines. While OLED laptop panel shipments experienced a decline in 2023, the market is expected to rebound with the introduction of diverse OLED products like variable refresh rate (VRR), Foldable, Rollable, and Slidable laptops.

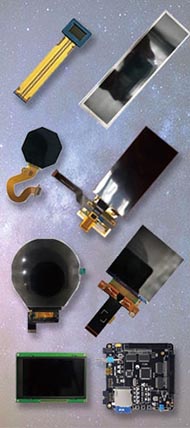

Related: BOE OLED LCD Porducts

Despite the current dip, optimism prevails regarding the future growth of OLED laptops, with projections suggesting a market penetration rate of 21.5% by 2028. In the tablet PC segment, OLED shipments are anticipated to rise, reaching 5.7% market penetration in 2024 and soaring to 17.9% by 2028, driven by advancements in folding tablet PC technology.

In the ever-evolving display panel landscape, major players are strategically expanding medium-sized IT panel capacity, transitioning from LCD to OLED production lines to capture a larger share of the high-end market. DSCC forecasts a compound annual growth rate of 51%, projecting OLED's dominance with a 75% market share in the high-end IT market by 2026. As more manufacturers invest in OLED technology, the global display panel pattern is poised for significant changes upon the release of 2026 capacities.