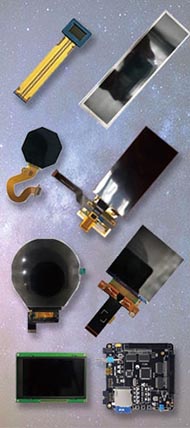

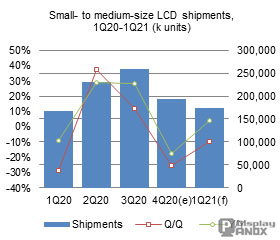

Taiwan's shipments of small to medium-sized LCD panels are projected to reach 174 million units in the first quarter of 2021, representing a 9.5% sequential decline, despite a 3.9% year-over-year increase. While the annual growth signals some resilience, underlying market dynamics and supply constraints point to structural challenges ahead.

Q1 Decline Driven by Component Shortages and Holiday Downtime

Q2 22020 Recap: Shipments Slump Amid Sanctions and Strategic Shifts

In the fourth quarter of 2020, Taiwan’s small to mid-size LCD panel shipments dropped to 193 million units, down 25.3% quarter-over-quarter and 17.8% year-over-year. This decline was driven by two major factors:

Tightened U.S. trade sanctions on Huawei, which forced downstream clients to cut or delay orders;

A strategic shift by panel makers toward notebook and large tablet panels (over 10.1 inches) to meet booming demand for remote work and distance learning devices.

Application Segment Trends: Handset Demand Slows, Tablet and Automotive Recover

Meanwhile, automotive panel shipments rebounded, driven by the gradual recovery of the global automotive industry, prompting panel makers to shift focus toward this growing application sector.

2021 Outlook: Full-Year Shipments to Decline 6.8% as AMOLED Gains Ground

With more smartphone brands adopting AMOLED as a standard for mid-to-high-end models, the structural shift in display technologies is expected to accelerate throughout the year.

Strategic Outlook: Diversification Key to Sustaining Growth