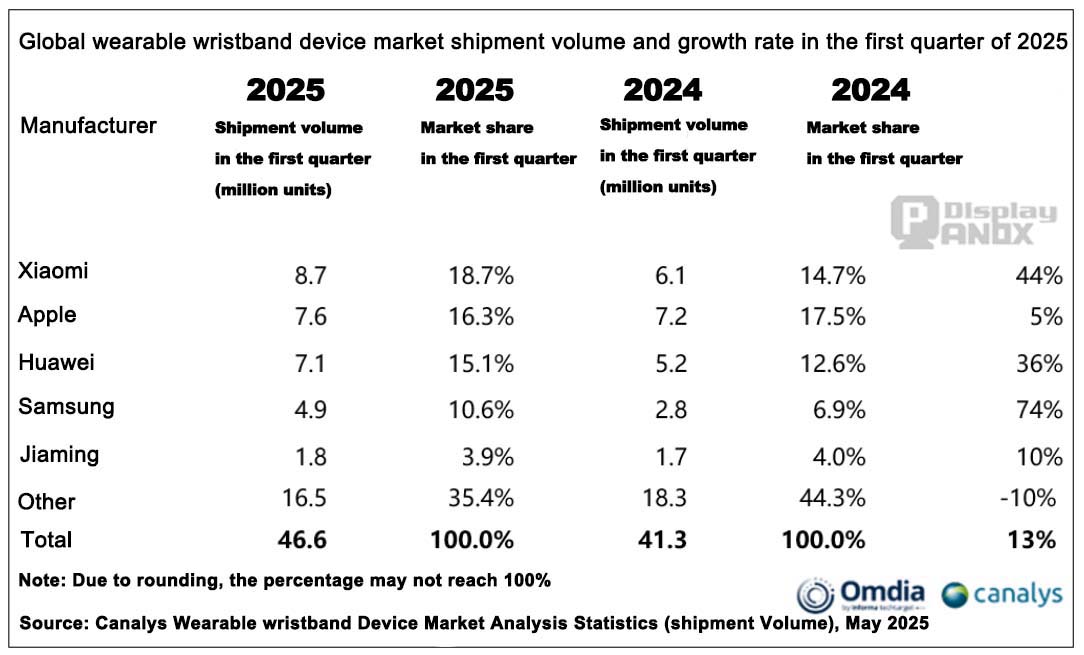

May 23 — According to the latest data from Canalys (now part of Omdia), the global wearable band market—including wearable bracelets, wearable smart watches, and other wrist-worn devices—grew by 13% year-over-year in Q1 2025, with total shipments reaching 46.6 million units.

The market rebound was driven by a low base in Q1 2024 and renewed consumer interest in health and fitness technologies. All major categories—basic wearable bracelets, basic watches, and wearable smart watches—recorded positive growth, underscoring the expanding adoption of wrist-based smart devices globally.

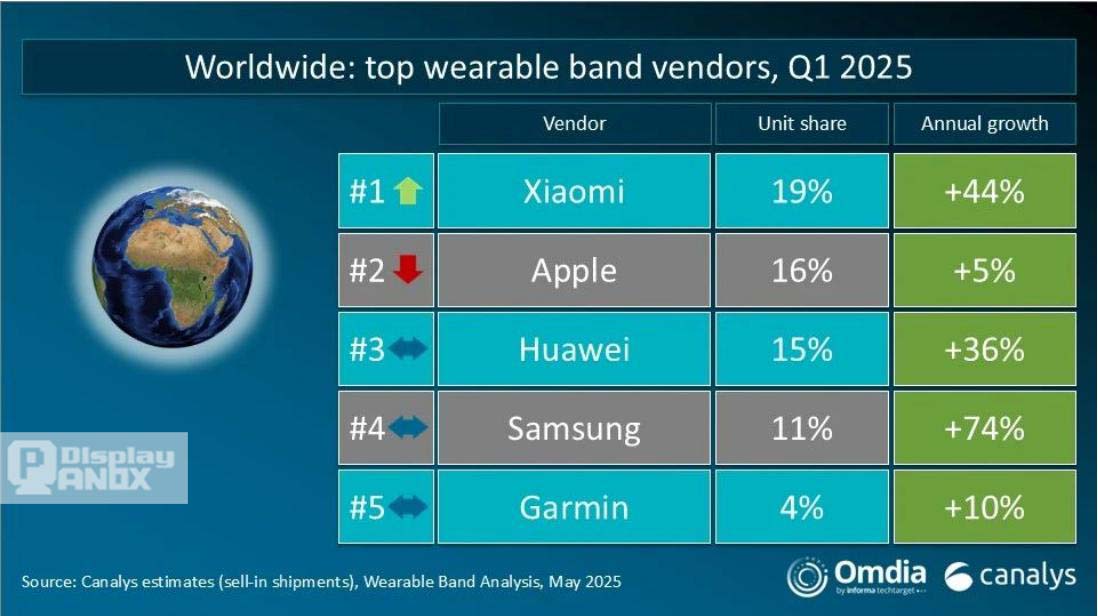

For the first time since Q2 2021, Xiaomi claimed the top spot in the wearable band segment. Its success is attributed to a broad portfolio of wearable bracelets and smart watches, as well as tighter integration through HyperOS, which enhances cross-device functionality, including handheld ecosystem devices like smartphones and tablets.

Apple secured second place, shipping 7.6 million units of its Apple Watch—a flagship wearable smart watch—marking a 5% increase year-over-year. While growth remained moderate, Apple has maintained a cautious approach. The company is expected to introduce major updates in the second half of 2025 to commemorate the 10th anniversary of the Apple Watch, potentially reigniting demand.

Huawei ranked third, with shipments up 36% year-over-year to 7.1 million units, thanks to strong performance from its GT and Fit series wearable smart watches. The accelerated global rollout of the Huawei Health App, integrated across both handheld devices and wearables, further strengthened its international ecosystem.

Samsung posted the strongest year-over-year growth among the top five vendors, increasing shipments by 74% to 4.9 million units. Samsung's dual-track strategy—offering affordable wearable bracelets for emerging markets while retaining premium positioning in developed regions via smart watches—proved highly effective.

Garmin rounded out the top five with a 10% growth to 1.8 million units. The brand's differentiated product mix and the introduction of its Connect+ platform boosted repeat purchase rates and increased average selling prices, particularly among sports and outdoor users of wearable smart watches.

Canalys emphasized that as hardware profit margins tighten, the wearable industry is transitioning from being hardware-driven to ecosystem-driven. Manufacturers are increasingly focused on building platforms and services that extend beyond just the wearable band and include tight integration with handheld devices and other smart hardware.

Looking ahead, the competition in the wearable bracelet and smart watch space will increasingly hinge on the depth of ecosystem integration and the value of connected services. Applications like health monitoring, fitness coaching, and seamless device syncing—especially between wearables and handhelds—will define user loyalty and long-term revenue growth. Subscription-based models and AI-driven insights are expected to play a larger role in driving the next phase of wearable innovation.

Verification Code*

Panox Display

Browse Articles by Category

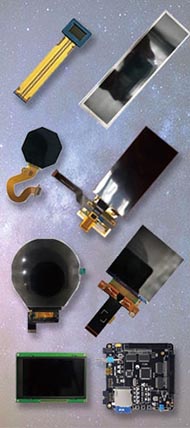

OEM SERVICE

Customized Touch Panel

HDMI/Type-C Controller/Driver Board

Custmized LCD/OLED

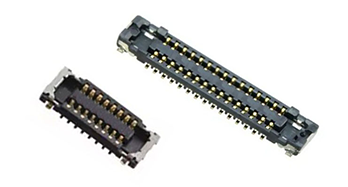

Free Connectors

Find a Display to Fit Your Application

For More OLED/LCD Panels

Get the Latest Displays

If our display fit your application, subscrlbe for monthly Insights

We got your inquiry and will contact you within one work day.

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798

If it`s urgent, try to contact

Whatsapp: +86 18665870665

Skype: panoxwesley

QQ: 407417798